For the second consecutive year, Shutts & Bowen Miami Partner Logan Gans was a featured speaker at the International Tax Conference’s (ITC) 39th Annual International Tax Boot Camp. This year, the conference was held virtually on January 13, 2021.

For the second consecutive year, Shutts & Bowen Miami Partner Logan Gans was a featured speaker at the International Tax Conference’s (ITC) 39th Annual International Tax Boot Camp. This year, the conference was held virtually on January 13, 2021.

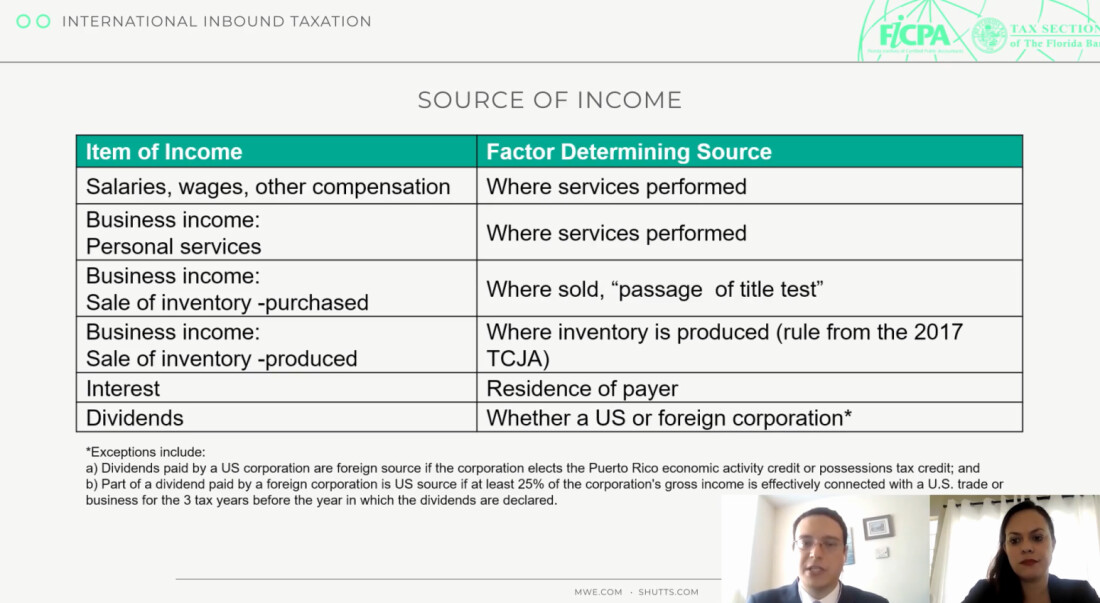

Logan discussed topics related to inbound taxation, including U.S. trade or business analysis, the structuring of U.S. investments, and the Foreign Investment in Real Property Tax Act (“FIRPTA”). Logan is also a member of the FICPA International Tax Committee that annually plans the International Tax Conference & Boot Camp.

The ITC Boot Camp was created to help tax professionals master need-to-know skills and trends in the international tax realm and is designed to prepare its attendees with a foundational understanding of international tax. This year’s conference focused on inbound and outbound international tax issues as well as the mechanics of the IRS’s Form 5471, which is an information return for certain U.S. taxpayers with an interest in certain foreign corporations.

About Logan E. Gans

Logan E. Gans is a partner in the Miami office of Shutts & Bowen LLP, where he is a member of the Tax and International Law Practice Group. Logan regularly represents clients on U.S. Federal tax, international tax, and state and local tax matters. Logan also advises U.S. clients on outbound corporate and tax planning, including Subpart F, GILTI, and FDII matters. He counsels foreign clients on their inbound investments in the United States, including U.S. real property, corporate restructurings, and cross-border mergers and acquisitions. Logan also advises clients on the use of qualified opportunity funds for investments in opportunity zones and qualified opportunity zone businesses. He also counsels high net worth private clients on estate, trust, and gift tax matters. A Florida Certified Public Accountant, Logan also is experienced in advising clients on partnership tax planning, pre-immigration tax planning, 1031 exchanges, tax due diligence, transfer pricing, and tax compliance. He also represents clients on tax controversy matters, including penalty appeals, the IRS Offshore Voluntary Disclosure Program (OVDP), the Streamlined Filing Compliance Procedures, and the Delinquent FBAR Submission Procedures. Prior to joining Shutts & Bowen, Logan was an International Tax Senior Consultant with the multinational accounting firm of Deloitte LLP.