This article appeared in the Daily Business Review on December 18, 2025.

Commentary provided by Glenn M. Cooper.

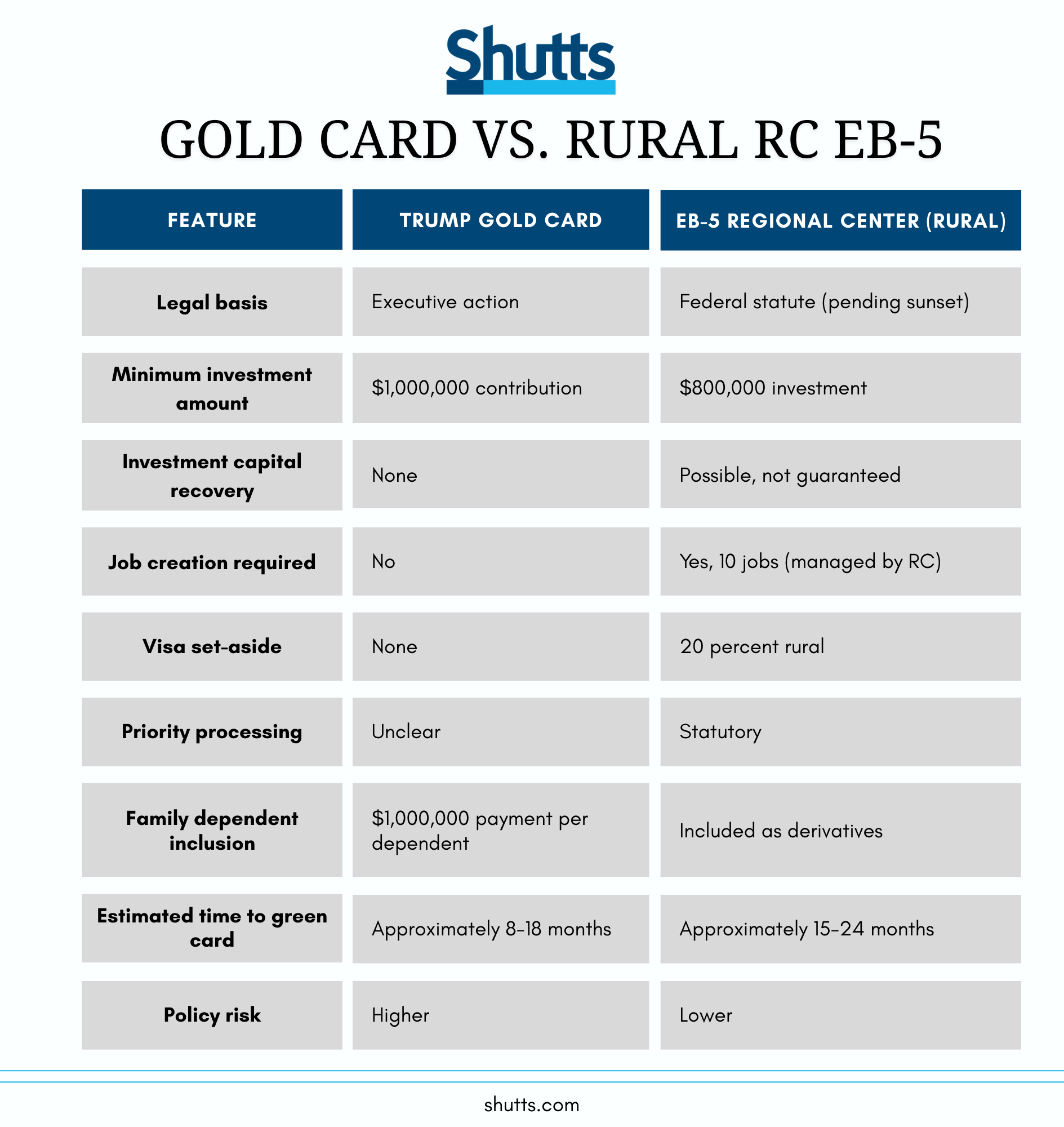

With the launch of the Trump Gold Card program on Dec. 10, 2025, foreign investors, family offices, and international advisors are seeking a comparative analysis of this new option versus the long-standing EB-5 Regional Center (RC) program, especially for EB-5 RC rural projects.

The Trump Gold Card is a newly launched immigration initiative created by executive action in coordination with Department of Commerce. It offers a pathway to lawful permanent residence for individuals who pay a $15,000 nonrefundable government processing fee, successfully pass background and security vetting, make a $1million payment characterized as a “gift,” and are classified under EB-1 or EB-2 immigrant visa categories, as determined by the Department of Homeland Security (DHS)/U.S. Citizenship & Immigration Services (USCIS) and subject to visa availability.

There is no investment project, no job-creation requirement, and no expectation of capital return. In practical terms, this is a contribution-driven immigration pathway layered onto existing employment-based immigrant categories.

The EB-5 Immigrant Investor Program is a congressionally enacted green card category that has existed for decades. Most investors today participate through USCIS-designated regional centers, and among those, rural projects are currently the most advantageous.

EB-5 requires a qualifying capital investment, funds placed at risk, and the creation or preservation of at least 10 full-time U.S. jobs. Unlike the Gold Card, EB-5 is not a fee-for-status model; it is an economic development program governed by statute and regulation.

From a legal and financial standpoint, the $15,000 government fee is nonrefundable, the $1 million payment is a contribution rather than recoverable capital. According to the Trump Gold Card site, each dependent family member, including spouse and unmarried children under 21, require a separate $15,000 processing fee and a separate $1 million contribution.

EB-5 requires an at-risk investment, typically structured with a defined sustainment period, loan or equity exit strategies, and offering documents supported by third-party economic reports. While repayment is never guaranteed, EB-5 provides at least a possibility of capital recovery, which is a key distinction for many investors.

Under current law, the standard EB-5 investment amount is $1,050,000, while a reduced $800,000 investment applies to projects located in a targeted employment area (TEA). Rural projects qualify as TEAs (with the reduced $800,000 investment) and also benefit from a 20% annual visa set-aside and statutory priority processing. These advantages may render rural EB-5 RC programs the most favorable EB-5 option available today. Note that spouse and unmarried children under the age of 21 are included in the principal EB-5 investor’s investment.

Because the Trump Gold Card is newly launched, all timing estimates remain provisional. Based on current program descriptions and standard immigration processing mechanics, initial filing and government vetting may take approximately one to three months, followed by several weeks to a few months for post-vetting approval and payment processing. Immigrant visa processing through a U.S. consulate may take approximately four to eight months, while adjustment of status within the United States may take approximately six to twelve months, if eligible.

The estimated total time to permanent residence is therefore approximately eight to eighteen months, assuming no litigation delays, requests for evidence, or adverse policy changes. As an executive-created program, timelines may change rapidly in response to legal, political or policy developments.

Rural EB-5 RC projects currently offer the fastest and most predictable EB-5 processing. I-526E immigrant petition adjudication generally takes approximately nine to eighteen months, as rural petitions qualify for statutory priority processing. Visa availability is often improved due to the 20% annual rural visa set-aside, which can reduce or eliminate backlogs depending on nationality.

Following petition approval and visa availability, consular processing or adjustment of status typically takes approximately four to twelve months. Conditional permanent residence is then issued for a two-year period. The I-829 petition to remove conditions is filed during the 90-day window preceding expiration of conditional residence, with adjudication timelines varying thereafter.

The estimated timeframe to initial green card issuance for rural EB-5 investors is approximately 15 to 24 months, depending on nationality and processing method.

The Trump Gold Card was created by executive action and may be subject to legal challenges, policy modification, or rescission by future administrations. While this does not mean the program will fail, it does introduce material policy and legal risks that investors should carefully consider.

The EB-5 RC Rural program is explicitly authorized by Congress and governed by statute and regulation. While it carries project, market, and compliance risks, it does not face uncertainty regarding the existence or authorization of the program itself.

According to the Trump Gold Card site, each dependent family member, including spouse and unmarried children under 21, require a separate $15,000 processing fee and a separate $1 million contribution, in addition to standard USCIS/consular filing fees and medical examination costs. As a result, total costs can increase significantly for families.

Under EB-5, spouse and unmarried children under 21 may immigrate as derivative beneficiaries without any additional investment requirement. Standard USCIS/consular filing fees and medical examination costs apply, but no additional capital contribution is required for family members.

One of the most important considerations for investors evaluating EB-5 today, particularly rural projects, is the statutory grandfathering protection provided under the EB-5 Reform and Integrity Act of 2022 (RIA).

The RIA is set to sunset on Sept. 30, 2027. However, the RIA includes a grandfathering provision that protects EB-5 investors from future program sunsets, lapses or legislative changes as long as their I-526 EB-5 immigrant petition is properly filed on or before Sept. 30, 2026. If the EB-5 petition is filed by that date, the petition remains valid and can be adjudicated even if Congress later fails to reauthorize the Regional Center program by the Sept. 30, 2027, sunset date. (It should be noted that I-526 EB-5 petition processing by USCIS is estimated to take longer than 15 months). The investor and qualifying family members remain protected under the rules in effect at the time of filing, and USCIS may continue adjudicating the case regardless of the program sunsetting or future legislative action affecting the program.

Investors should not wait until close to the Sept. 30, 2026, deadline to begin the EB-5 application process but rather should start the process with an immigration attorney immediately to have ample time to perform due diligence on regional center projects and to prepare a thorough and comprehensive EB-5 petition file which will be ready to submit to USCIS well in advance of the Sept. 30, 2026, deadline. This planning window is particularly important given the extensive source-of-funds documentation, project due diligence, and compliance requirements inherent in EB-5 cases.

The Trump Gold Card currently has no statutory grandfathering protection and remains subject to policy changes, litigation, or rescission. EB-5 filings made under the RIA, by contrast, are explicitly protected by federal law once filed.

From a legal and risk-management perspective, EB-5 rural Regional Center projects, when filed by Sept. 30, 2026, offer a uniquely protected and congressionally backed pathway to U.S. permanent residence, combining lower investment thresholds, visa set-asides, priority processing, and statutory grandfathering protection.

The Trump Gold Card may appeal to a certain group of investors seeking speed and simplicity, but it remains new, untested, and subject to significantly higher policy and legal risk, with no equivalent grandfathering safeguards. As time passes, clarity regarding the Trump Gold Card program should be elicited based upon case filings, policy changes and legal actions, which may or may not make the Trump Gold Card more attractive.

As always, the appropriate strategy depends on nationality, family structure, capital objectives, timeline goals, financial means, and tolerance for uncertainty, and should be evaluated carefully with qualified immigration legal counsel.

Glenn M. Cooper is a partner in the Miami office of Shutts & Bowen. His practice focuses on immigration. He can be reached at 305-415-9084 or gcooper@shutts.com.